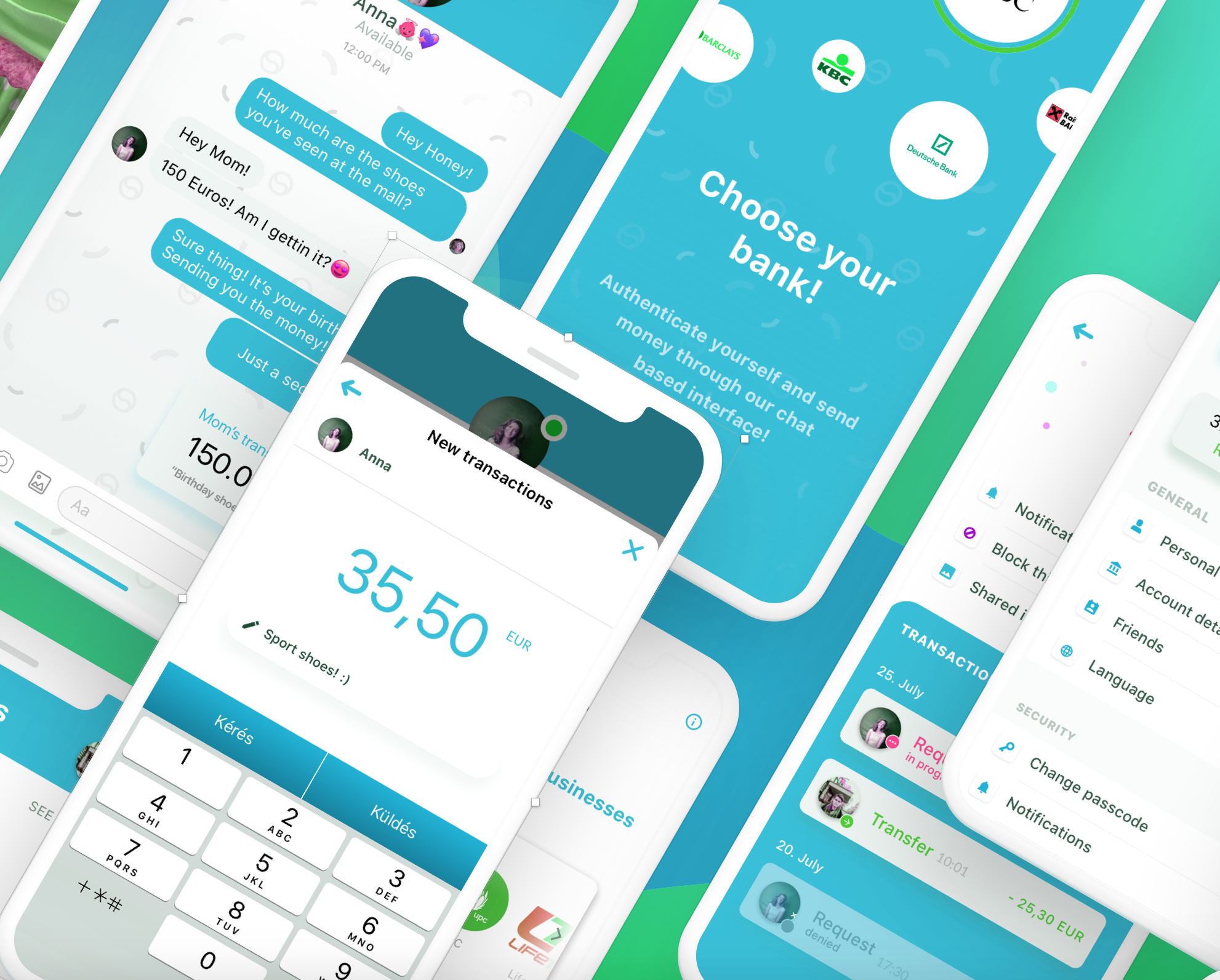

Overview of UX strategies and solutions across projects

TASKS

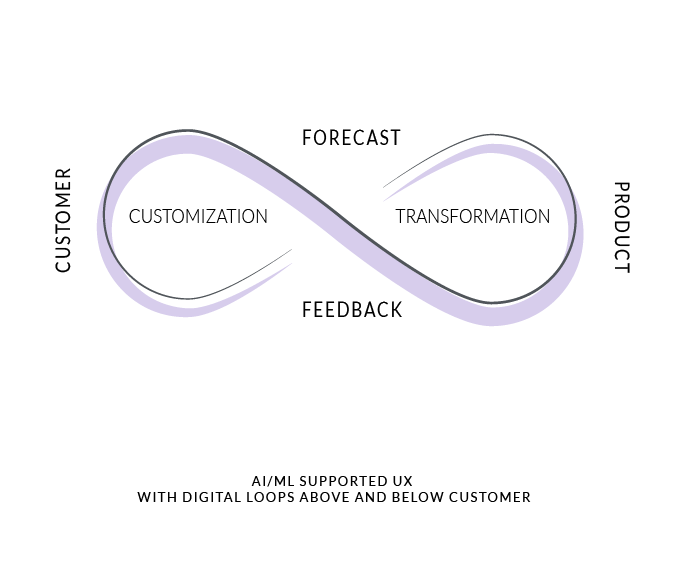

Research, opportunity mapping, UX architecture, rapid prototyping, strategic design, brand design and placement, responsive web and mobile product development, machine learning.

78

Expect tailored solutions

76

Want a self-directed experience

76

Monitor and evaluate vendor performance

40

Consumer trust in banks

65

Consumer trust in Tech companies

79

Expense managers

73

Personal Finance

61

Payments

45

Banks

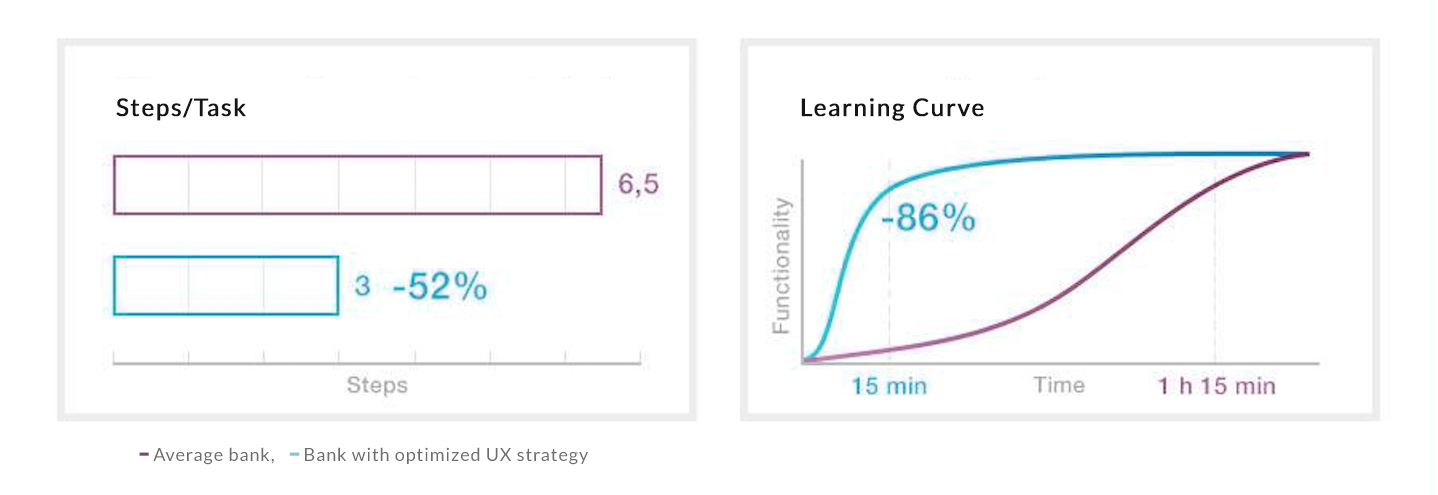

RESULTS

Providing continuous sustainable experience across products and markets facilitates trust and loyalty resulting in growing usage and adoption: the elements critical to the success of financial services in a super-fluid marketplace.

This is why achieving quality experience through innovation means also innovating the success metric itself. According to Satya Nadella CEO of Microsoft: “Revenue is a lagging…, usage is a leading indicator”.

In this respect, HEART (Happiness, Engagement, Adoption Retention, Task Success) framework helps maintain product health, while having KPI plugged directly into UX strategy ensures that revenue will follow the usage.

118

Customer satisfaction

64

Usage Increase

82

Adoption Increase

45

Readiness to switch decrease